Contents:

However, once the stock has had a chance to pull back and consolidate, the bull flag should produce a breakout, allowing the stock to resume its prior momentum. This means that sellers were still far fewer than buyers. In other words, there are more traders willing to buy the flag than sell it. A bull flag must have orderly characteristics to be considered a bull flag. There must be a series of lower highs and lower lows within the bull flag consolidation. A lower volume signature should accompany the price action within the flag.

An intense rally followed by a flag-shaped trend halt helps traders identify bullish flag formations. On the contrary, a bear flag pattern is created by a bearish or downward trend , which is followed by a lull in the consolidation zone or trend line. A bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. It signals that the prevailing vertical trend may be in the process of extending its range. Bull flags are the opposite of bear flags, which form amid a concerted downtrend. In the bull flag chart pattern, when the flag portion fails to maintain its downward momentum after identifying the pole, crypto traders can place the entry.

On the chart, the stock price rises rapidly. It forms an almost straight pole, then consolidates over a period of time. In the consolidation period, the stock price might rise or fall, but only in small increments. And if you want to trade it, you need to understand the bull flag formation and strategy. You need to be able to recognize when it’s happening.

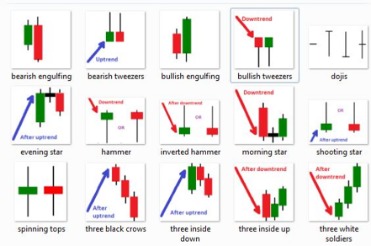

2-3 Pattern: candlestick model trading

Should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. The stocks I’m watching in November aren’t outliers … The market has been in recovery mode since mid-October…. Interested in trying the number 1 trading platform? As it picks up volume, the top part of the consolidation would be an ideal entry at around $7.70. The stop would be at the bottom of the consolidation at $6.

Which is why I’ve launched my Trading Challenge. I’m extremely determined to create a millionaire trader out of one my students and hopefully it will be you. The bull flag rises, dips, and consolidates before continuing to move up. With this pattern, buying the breakout is the easy part. Set the breakout level at which to place the order.

Recognize upward movement, a momentum that can be framed under a string of up-trending bars with hardly any retracement bars. Enjoy technical support from an operator 5 days a week, from 9 a.m. Volatility is a crucial part of any trading. Thus, the Take-Profit order can be too far in the highly liquid market. We would recommend using trailing take profit.

Conclusion. Use or Avoid the Bull Flag Pattern

If you only want to trade bull flags and there’s no bull flag then … just stay away. Using the bull flag pattern and its variations can help you trade smarter. But remember to use it in combination with other indicators. What should you look for to spot these fast movers? Read on to learn what the bull flag pattern is, how to use it, and real-world examples.

Using the volume indicator, traders verify the bull flag signal following the price of a cryptocurrency of their choice . Then, on the price chart, crypto traders use the volume indicator and predict that trading volume will decline during the price correction. When the price consolidates, the Volume indicator is expected to decrease as bulls aren’t strong anymore. Simultaneously, the upward breakout of the flag’s resistance will signal the strength of bulls, so the trading volumes should increase. In common words, the bull flag pattern appears due to a pause in the uptrend.

If you realize that you’re in a shake-out , move your stop loss below 20 exponential moving average. That should give you enough room not to get your stop out. An unusual volume will mostly indicate that something/someone is trying to create price manipulation that might be the “shake out” we just covered. This is 1 out of the 3 most accurate trading strategies, so make sure you watch the others as well.

Learn More

For clarity and ease of https://g-markets.net/ing, this trading guide focuses on bull flags. Different traders might identify the flag pole differently. Consider the second bull flag pattern in the chart above. In the first bull flag pattern, there were long lower shadows at the bars ending each bearish leg. The field of crypto-trading is quickly adopting tactics from technical analysis.

But for the sake of consistency, master trading one type of trend first by having trades clocked in. He is the most followed trader in Singapore with more than 100,000 traders reading his blog every month… Now, there are many ways to tweak this Bull Flag trading strategy to your needs.

Once early bears realize the strength in the overall move, they give up their early shorting efforts. A bull flag is a bullish stock chart pattern that resembles a flag, visually. The pattern occurs in an uptrend wherein a stock pauses for a time, pulls back to some degree, and then resumes the uptrend. During a range, wait for the price to form a bull flag pattern below resistance. Because when the market is in a range, it will have to break out eventually and form a bullish flag pattern.

What is the meaning of a Bull Flag Pattern and how does it work

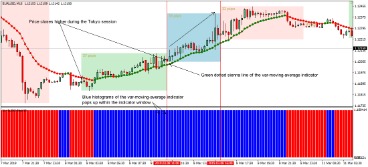

For more inbull flag trading strategyation, check out our Privacy Policy. If you observe the EUR/USD chart below, you can see each formation part. Funded trader program Become a funded trader and get up to $2.5M of our real capital to trade with. A downtrend channel represents a lower-low structure. The most complete automated cryptocurrency trading platform out there. Citytradersimperium.com needs to review the security of your connection before proceeding.

They are called bull flags because the pattern resembles a flag on a pole. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. The flag can be a horizontal rectangle but is also often angled down away from the prevailing trend. Another variant is called a bullish pennant, in which the consolidation takes the form of a symmetrical triangle. A bull flag is comparable to a bear flag, with the exception that the trend is upwards.

A bull flag means that there is a pause, albeit brief, in the upward momentum of a stock’s move to higher prices. It indicates that the stock might be in a temporary overbought condition, which will likely bring in some early selling pressure in a young bull run. Now, the first thing you need to do is to spot a downtrend and wait for the price to break its trend line resistance. For long-term trends, consider using the 200-period moving average. For medium-term trends, consider using the 50-period moving average.

A bull flag doesn’t typically form an apex, nor is it completely symmetrical. A bull flag will most often have a downward trajectory instead of a horizontal and level consolidation. Another scenario that fuels bull flags are short squeezes. If you can identify key levels on a chart where shorts could be underwater, then see a bull flag form, it could be indicative of a coming squeeze. We discuss this strategy in detail in our post on liquidity traps.

Bull Flag Trading Pattern Explained

The essential characteristic of a bullish flag pattern is a short downward consolidation, after which the instrument shows a sharp rise. A bull flag pattern is a chart pattern that occurs when a stock is in a strong uptrend. It’s not uncommon to see the term “pennant” whenever there’s mention of flag patterns. The only difference is that the consolidation of a pennant pattern features converging rather than parallel trend lines. The bull flag pattern is advantageous when accurately spotted. It helps investors gain profits by entering the market at the right time.

Preview: Ideal Power’s Earnings – Ideal Power (NASDAQ:IPWR) – Benzinga

Preview: Ideal Power’s Earnings – Ideal Power (NASDAQ:IPWR).

Posted: Wed, 01 Mar 2023 19:01:21 GMT [source]

This is the point where you know that this setup is no longer working out and its time to take a loss and move on. The best way to measure the profit target is to use the higher and lower bull flag channel lines and use the distance to set the expected profit target. The pattern may be used to buy bullish breakouts or trade the pullbacks of uptrends.

- That being said, a sound and well-executed strategy based on the identification of flag patterns with proper risk management will benefit your portfolio in the long run.

- Price corrections are often represented in multiple ways – pennants, downtrend channels, or sideways movement.

- Moreover, as discussed above, the signals to identify bullish pattern trends and the procedure to spot them involve simple steps.

If the flagpole was formed by a move downwards, it forms a bearish flag. If the support of a bear flag is broken, traders can be more confident that the price will continue to move downwards by the length of the pole. Bull Flag is a prevailing uptrend continuation pattern. It is formed when price movements create a narrow, sideways consolidation that slopes downward. A bear flag pattern is characterized by an initial sharp decline and then a period of consolidation. With most bear flag patterns, the volume increases when the pole is being formed, then remains at its new level.